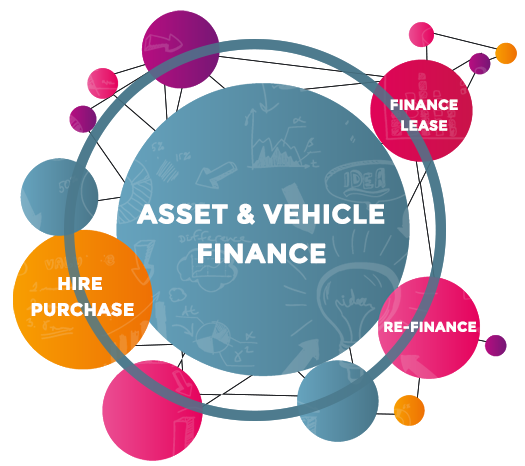

Asset & Vehicle Finance

Asset & Vehicle

Finance

- Hire Purchase

- Sale & Leaseback

- Finance Lease

- Operating Lease

This is the most traditional form of Asset Finance and may be used if you want to own the Asset within your Business but don’t want to pay for it all in one go. An Asset finance Company buys the asset for you and charges you an agreed amount plus interest (either fixed or variable) over an agreed repayment period. At the end of this agreement, a modest fee is paid and you will then own the equipment. The term can be varied to suit your cash flow requirements and it may be possible to use a balloon payment to reduce your monthly repayments subject to approval.

If you have already purchased the Asset outright using your own money, then you may be able to arrange a Sale & Leaseback arrangement, providing the transaction is completed within a maximum of 90 days of the goods being purchased.

Unlike Hire Purchase, ownership never passes to the named Customer/Hirer on a lease agreement. The customer effectively rents the asset for a predetermined period of time from the finance company. At the end of this period the hirer traditionally has 3 options:

- Retain the use of the asset by paying a secondary period rental.

- Sell the goods to a third party on behalf of the finance company

- Return the asset to the finance company.

The Hirer has use of the asset/vehicle for a fixed period of time and never owns the asset. There is a pre-agreed residual value and therefore your monthly repayments are reduced. This allows you to fix the cost of using the asset over time.

Here at Hornby Commercial, we work with a wide range of Asset Finance Providers, who lend to a wide range of Sectors. Some of our funders are able to provide rates to rival Manufacturer Discounted Finance. Talk to us today for a no obligation quote on your next Vehicle or Machine purchase.

“We are proud of the part we play in helping our clients achieve their successes.“

It’s this simple…

Tell us what you need and we’ll do the rest

Get the thumbs up! Our lenders like to say yes