Borrowing money for your Business? – Here are 5 things YOU should consider.

When Busy Business owners ask their lender for additional funds, they aren’t always aware of the key things they should be considering before they say yes to the deal being offered.

Here are our top 5 tips to make sure that you get the most suitable type of finance when you need to borrow money for your Business.

1. Why – Are you borrowing money to purchase a new asset, fund your cash flow due to growth or expansion, or cover a gap caused by a problem in your business?

Each of these reasons will require a different type of finance, and it is important to understand the why when considering any request for funding for your business.

2. Term – How long do you need the money for? If you are buying a property for your Business for example – you would expect to spread the cost of this over a number of years in order to make the repayments affordable.

You wouldn’t go and buy a new home on your Credit Card – so purchasing property will always be considered as a longer term finance option unless you are Bridging a gap ahead of a repayment from another source.

You may be buying a vehicle or piece of plant an equipment using Asset Finance. Your term should be spread over the useful lifetime of the asset.

Security for the lender is a charge over the Asset you are purchasing with repayment Terms often spread over 12 – 60 months depending upon the age of the asset and it’s expected lifespan.

With Hire Purchase Finance this security will be released by the lender upon receipt of the final payment where ownership will fully revert to you.

3. Affordability – You have established why you need to borrow the money, which will narrow down the type and repayment terms of funding you need.

You now need to consider whether you have enough cash within your Business to comfortably make the necessary repayments.

When Calculating Affordability – Don’t forget to take into account the requirements of the business to fund its existing borrowing commitments, pay its tax, and cover any Directors/Owners salaries.

4. Interest Rates and Arrangement Fees – These can make all the difference to your Business, and it is important to make sure that you are achieving the best rate and fee structure possible when you arrange your new borrowing.

Many Businesses will operate a significant overdraft facility which they will pay a fee to renew annually.

We regularly find that if there has been enough headroom in an overdraft facility to absorb the cost of buying an asset for example or carrying out improvement works to premises the overdraft has been used to fund this work. This can mean that the customer can end up paying every year a fee on the amount of money they are borrowing, rather than a one-off fee on a term loan which is repaid over time.

Paying an annual fee will work out far more expensive in the long run, so make sure you have taken fees into the account when considering the overall cost of your borrowing facility.

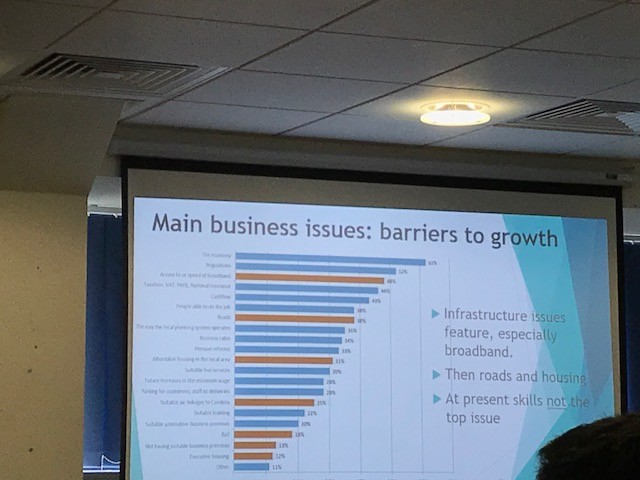

5. Not all Businesses are the Same – and Not all Lenders will want to do business with you!

It was not so very long ago that if you wanted to borrow money for your Business you made an appointment with your local Bank Manager and hopefully got the, yes you wanted!

Since the last financial crisis hit in 2008, Business Finance has undergone a dramatic transformation. There are now many new entrants to the market, and many of these lenders have bespoke products to suit particular types of clients or borrowing needs.

Your Business may be an excellent one, but if you operate in a Sector that your lender is not comfortable in, then you won’t get the positive response you are hoping for.

Our advice is always to seek professional advice ahead of applying for finance for your Business – A well-structured finance model will help your business to thrive in the future.

Our Team are always happy to take a call to discuss your plans and regularly work with other Finance Professionals to help Business owners arrange the finance they need.

There are lots of lenders in the market who advertise aggressively – these lenders are often not the ones offering the most competitive rates. It always pays to know who you should be talking to.

For a no obligation discussion about how your Business Finance works, – why not arrange a free initial consultation today. We are always happy to take calls from customers old and new as well as their professional advisors. We look forward to hearing from you.

Call – 01229 588077

Email – Finance@jfhornby.com