Working Capital

Working Capital

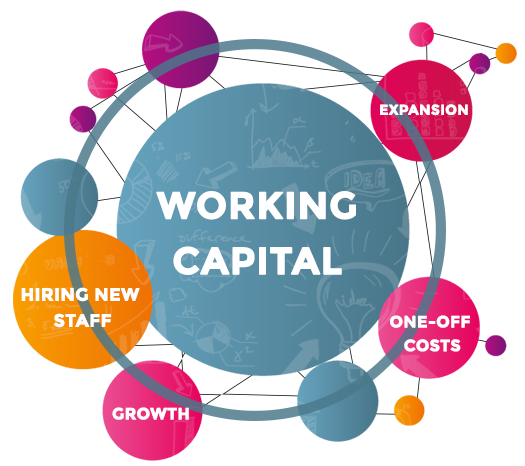

Managing the working capital within your Business is the key to ensuring that you can make the most of opportunities for growth. Understanding the terms of how your Business trades with both customers and suppliers will help you to ensure that you have enough cash flow to keep on track.

Do you need money for Growth, Expansion or hiring new staff? Talk to us today to see how we can help you obtain the finance you need?

Do you need to pay your suppliers for stock before you receive the money from your Customers for finished goods? If so, you may well have a working capital funding gap which will need to be met by a short-term working capital facility.

Overdrafts are the usual solution available from your Business Bankers to meet your working capital needs, however, they are certainly not the only method of funding your working capital requirements.

If you are approaching your Bank for an overdraft facility, be prepared to demonstrate how your facility will be repaid and how much funding you need. You may also be asked to offer Security to the Bank in order to arrange an overdraft for your Business. Be prepared to offer a Business Plan, and some financial forecasts to show our requirements.

Unsecured Business Loans

Tax and VAT Loans

Insurance Funding

Invoice Finance

“We are proud of the part we play in helping our clients achieve their successes.“

It’s this simple…

Tell us what you need and we’ll do the rest

Get the thumbs up! Our lenders like to say yes